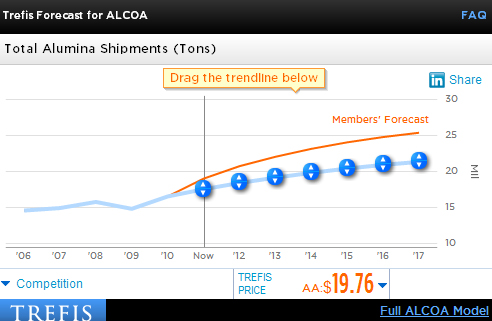

Alcoa’s (NYSE:AA) total alumina shipments rose from 14.6 million tons in 2006 to 16.5 million tons in 2010 with a blip in 2009 due to unfavorable economic conditions that led to a decline in the overall industrial output and demand for aluminum. Alcoa, which competes with mining giants like Rusal, Rio Tinto (NYSE:RIO), BHP Billiton (NYSE:BHP) and Chalco (NYSE:ACH), is upbeat about the global outlook for aluminum and expects the strong demand to continue in the next decade. Last quarter, Alcoa reported almost $6 billion in sales, up 20% year-over-year. (See Alcoa on Track for a Bumper Year)

Given the unique characteristics of aluminum and its growing demand, we expect Alcoa’s alumina shipments will rise to 21 million tons by the end of our forecast period. Trefis members, however, predict a more optimistic scenario with the shipments reaching 25.4 million tons – implying an upside of close to 5% to our Alcoa stock price estimate.

We have a Trefis price estimate of $19.76 for Alcoa’s stock, implying a premium of 28% to current market price.

Unique Qualities and Usage of Aluminum

Aluminum is lightweight and using it in automobiles can help reduce vehicle weight and improve fuel efficiency. Lighter automobiles also mean lower emissions. The unique characteristics of aluminum being malleable and ductile makes it ideal for making cans. Moreover, it is very convenient to use aluminum foil for wrapping and storing food and is widely used in the food industry. (See Good Things Come in Aluminum Packages for Alcoa)

Positive Global Outlook for Aluminum

Alcoa predicts the global consumption and supply of aluminum to double from its 2010 levels by 2020 driven by an increasing demand for more efficient infrastructure and transportation solutions [1] It predicts aluminum demand will grow at a compounded average growth rate of nearly 7% annually. This represents a growth in annual demand for bauxite from 214 million tonnes to 400 million tonnes. Alumina is expected to grow from 82 million tonnes to 156 million tonnes in a year, and aluminum growth would be from 39 million tonnes to 73 million tonnes per year.

Alcoa forecasts the automotive and aerospace markets will be the main drivers for growth in aluminum demand, due to the growing need for more fuel-efficiency spurring increased competitiveness of aluminum to the traditional metals used in the construction of cars and airplanes.