Alcoa (NYSE:AA) recently announced its performance for the first quarter of 2011. [1] Based on these figures, we have updated our price estimate to $17 from the earlier value of $17.68. While the increase in aluminium prices and divisional shipment figures have been close to the values we initially estimated, we revised our price estimate due to the significant reduction in the cash & cash equivalents held by the company. The company competes with other international metals and mining giants like Rusal, Rio Tinto (NYSE:RIO), BHP Billiton (NYSE:BHP) and Chalco (NYSE:ACH).

Results at a Glance

The fact that the aluminium industry has recovered from the economic downturn and now faces rising demand came through in Alcoa’s Q1’11 earnings. The company reported almost $6 billion in sales for the quarter, more than 20% higher year-over-year (yoy). While this is just a 7% increase over the previous quarter (Q4 2010), the net income increased by almost 20% – crossing $300 million sequentially.

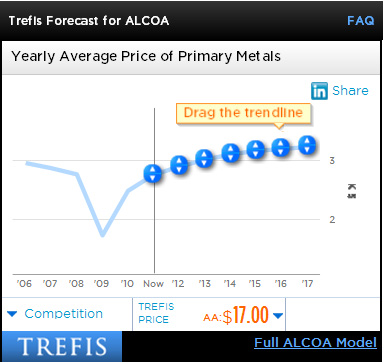

The primary metals division continued to be the biggest source of income for the company bringing in revenues in excess of $2.8 billion, and an after-tax operating income (ATOI) of more than $200 million.

Also, the decrease in cash balances for the quarter can be explained by the investments by Alcoa in Ma’aden and Electronics Recyclers International, the acquisition of TransDigm, and the increase in its working capital.

Might be Most Profitable Year Yet

The increasing demand for aluminium in packaging, automotive, commercial transportation and industrial products has been helping aluminium prices while driving shipment numbers. We wrote recently on the packaging industry’s use of aluminium in a note titled Good Things Come in Aluminum Packages for Alcoa. Increasing copper prices have also helped aluminium step in as a substitute, and for Alcoa in particular. We discussed this our article titled Rising Copper Prices are Good News for Aluminum Producer Alcoa. In late 2010, Alcoa predicted a 12% growth in the global demand for aluminium in the year 2011, and it has reaffirmed this as a part of its earnings release. This would help support higher prices through the year. We believe that the primary metals division would continue to drive value for Alcoa – with the company’s decision to restart operations at its Massena, Intalco and Wenatchee plants help this outlook.