Exchange traded products that invest in aluminum followed Alcoa shares lower Tuesday morning after the Dow component reported quarterly results that disappointed Wall Street.

Alcoa said it swung to a profit in the first quarter as aluminum prices rose, but traders punished the stock and Alcoa shares were down about 6% in recent action.

The company said it sees a 12% increase in aluminum demand this year.

However, some Wall Street analysts think aluminum prices are set to take a breather.

BMO Capital Markets downgraded Alcoa to underperform after the quarterly results mostly on expectations of a weaker aluminum price in the quarters ahead.

“In terms of the industry outlook, demand for aluminum is rising in 2011 but so is supply,” BMO said in a research note.

Aluminum exchange traded funds represent a tiny fraction of the overall ETF market.

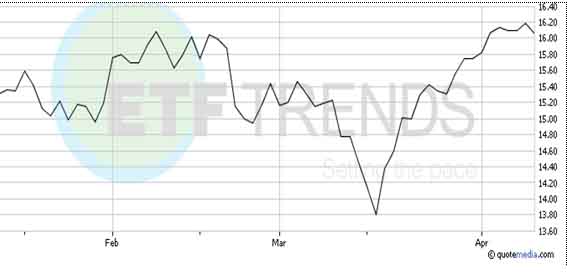

The $9.7 million iPath Dow Jones-UBS Aluminum Subindex Total Return ETN (NYSEArca: JJU) has been strong since mid-March as industrial metals have rallied. The exchange traded note slipped 1.5% Tuesday.

The $5.7 million Global X Aluminum ETF (NYSEArca: ALUM) invests in companies that are active in some aspect of the aluminum industry.

Global X Aluminum ETF