Alcoa ( AA ), the world leader in the production and management of primary aluminum, fabricated aluminum and alumina, has very good reason to rejoice with rising copper prices. This is because aluminum is generally accepted as a cheaper substitute to copper in many applications, and many manufacturers are seriously considering switching to aluminum with copper reaching all-time high prices early this year. This inclination towards aluminum would also benefit Alcoa's competitors which include Rusal, Rio Tinto ( RIO ), BHP Billiton ( BHP ) and Chalco ( ACH ).

Alcoa's products are used in a wide variety of products from aircrafts and automobiles to commercial transportation and packaging. The company also sells non-aluminum products like aerospace and industrial fasteners. Our price estimate for Alcoa, at $17.68 , is roughly in line with the stock's market price.

Copper vs. Aluminum: Have the Scales Already Tipped? Copper is primarily used in electrical appliances and construction. It is used widely in electrical appliances because it is an excellent conductor of electricity. Notably, about 65% of copper usage is attributable to electrical appliances. Construction applications make up the bulk of the remaining share of copper usage - the metal is often used for roofing and plumbing in addition to its use in automobile and ship manufacturing.

Copper prices are currently at an all-time high, above $4.5 per pound. In comparison, aluminum is priced at about $1.1 per pound. Given the costs of retooling manufacturing processes and the extra aluminum it takes to conduct the same amount of electricity as copper, it often becomes more economical to use aluminum instead of copper if copper prices rise above $3.50 per pound.

So How Much Can Alcoa Gain? Over the past 5 years, aluminum has substituted about 2% of the copper market on average. While this might not seem like much, this number is primed for rapid growth. Alcoa predicts that if copper prices continue to rise at their current pace, then aluminum could potentially substitute 20% of the global refined copper market.

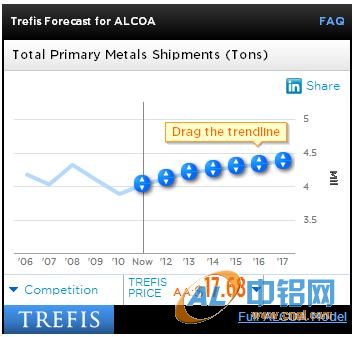

If Alcoa's primary metal shipments increase by 20% in the years to come, this metric could surpass 5.2 million tons by the end of our forecast period (vs. our base case estimate of about 4.4 million tons). This would represent nearly 10% upside to our $17.68 price estimate for Alcoa , pushing our estimate to about $19.20.

See our full analysis and $17.68 price estimate for Alcoa .The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of The NASDAQ OMX Group, Inc.