Aluminum stocks in China’s five major markets fell for two consecutive weeks and will remain near multi-year low for the foreseeable future, SMM predicts.

SMM attributes the recent decline to low shipments from northwest China, especially Xinjiang. It is estimated that over 150,000 tonnes of aluminum ingots are now being piled up at Urumqi and Wucaiwan railway stations.

SMM learned aluminum smelters in Xinjiang are negotiating with local railway bureau over aluminum ingot shipments with exclusive trains so as to ease severe inventory backlogs. Hence, shipments from Xinjiang are expected to grow gradually this coming week, but it may take at least six weeks to digest inventory backlogs in northwest China.

Rising Costs Squeeze Profit at Chinese Aluminum Smelters, SMM Says

On the other hand, some smelters cut shipments, hoping to push up spot premiums in this way. As such, overall aluminum stocks will remain low for the foreseeable future.

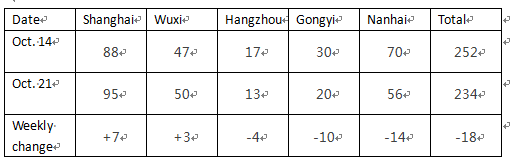

The table below shows details of aluminum stocks at China’s five major markets:

Unit: 1,000 tonne