Banks' required reserves were raised by 50 basis points on Friday and further interest rate rises to tackle inflation were not ruled out by Zhou Xiaochuan, governor of the People's Bank of China.

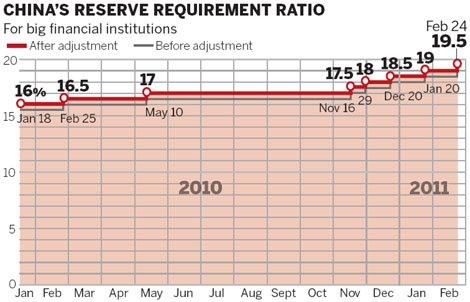

The move by the central bank was the eighth hike since the beginning of 2010 to control inflation in the world's second-largest economy.

The measure will be effective from Feb 24, after which the reserve requirement ratio for big commercial banks will be 19.5 percent. The move is estimated to mop up about 350 billion yuan ($53.2 billion) from the market.

Zhou said raising the reserve requirement is just one weapon in the fight against inflation.

China's consumer inflation picked up to 4.9 percent in January from 4.6 percent in December. It hit 5.1 percent in November, a 28-month high. The recent drought in some major grain-producing areas, together with international grain price hikes, has led to increasing worries about rising inflation.

Asset bubbles are also a major concern for policymakers. New home prices rose in January from a year earlier in 68 out of the 70 cities monitored.

To soak up excessive liquidity to help curb increasing inflation and asset bubbles, the central bank raised interest rates in February for the third time since mid-October.